Whatever part of the motor trade industry you work in, there are ways you can mitigate the impact of rising insurance policy costs. These include measures to reduce claims of your own, measures to reduce claims against you, and other ways to generally make sure you’re not paying over the odds.

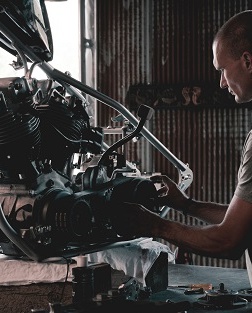

Find a reliable local garage

If repairs are not your specialism, then a good local garage can save you money on your policy costs simply by using them for minor repairs rather than making a claim.

Discuss your policies in person

Having the one-to-one client services that Tradesure provides means our friendly team can talk through the finer details of your trade activity with you, and apply their expertise and experience to ensure you get the best quote possible, both in terms of appropriate, tailored cover and price.

Develop great customer service yourself

As a professional tradesman, your customer relationships are a key part of your business. Over time, as you develop a rapport with your customers you can reduce the chances of any minor accidents or incidents being dealt with via claims. A promise based on trust and a speedy resolution will save you money every time, so always aim to develop great customer relationships.

Review your business

Regularly reviewing your motor business operations will ensure your insurance is suitable and appropriate. Your Tradesure account manager will be able to speak to you about how you can make savings.

Choose the best payment options

Check which insurance payment options will cost you the least in the long run and look at things like finance packages, paperless billing, payment methods and associated charges. We provide low interest rates and always inform you of any additional fees upfront, which isn’t too common in the industry.

Drive safe

Okay, so this one’s obvious. But taking the time to go carefully with other people’s vehicles as well as your own is going to safeguard you from avoidable accidents that result in a claim and affect your future policies.

Most Popular

Featured

SIMILAR BLOG POSTS

Tradesure Insurance partners with Global Telemetrics

We are excited to announce that we have partnered with Global Telemetrics. At a time where vehicle theft is on the rise, protecting your vehicle has never been more important. That’s why we’re proud to partner with Global Telemetrics, a market leader in advanced GPS tracking technology, to offer customers an additional layer of security […]

Tradesure Insurance receives Feefo Platinum Trusted Service Award 2024

We are proud to announce that we have achieved Platinum Trusted Service Award on Feefo. This accomplishment reflects our dedication to providing an exceptional service for customers, and it means we have received the highest possible accreditation from Feefo. Feefo is the world’s largest provider of verified reviews. The Platinum Trusted Service Award is given […]

Tradesure Insurance employees celebrate raising over £1,350 for charitable causes in 2023

We’re pleased to announce that £1,389.81 has been raised for various charities following employee and company contributions throughout 2023. Pictured: Some of the Tradesure Insurance employees wearing Christmas jumpers for the Save the Children Charity Day in December 2023 This monthly fundraising initiative is organised by John Wilkins (Tradesure Manager), and includes a series of […]

Christmas and New Year opening hours 2022

Opening hours for our broking team over the Christmas and New Year period 2021/22. Click here for more details.

Automotive trends we’ve seen in 2022

With another year drawing to a close, the face of the motor trade has shifted once again. The pandemic disrupted traders massively, but prices rocketed once restrictions were dropped. We reported in the summer that there’d been year-on-year price growth for 26 consecutive months, but likewise traders were struggling for stock. So has 2022 been […]

Christmas Raffle in support of Edward’s Trust

Edward’s Trust support children, young people and families through bereavement. The draw takes place on 6th December 2022.

Partnering with Edward’s Trust to support bereaved children and families

Tradesure Insurance Services are partnering with local charity Edward’s Trust to help support children, young people and families facing loss and surviving bereavement in the West Midlands. Edward’s Trust is a specialist provider of holistic family bereavement support, based in Edgbaston, Birmingham. The Trust was founded by Peter and Hilary Dent in 1989 in memory […]

What is motor trade internal risk?

Motor trade internal risk is a type of insurance that covers non-road risks for motor trader, such as liability cover or stock on site.

Vehicle write off categories explained

If you find yourself in the unfortunate position of having a car written off, it’s helpful to understand the vehicle write-off categories.

Top 5 fuel finder apps in the UK

Here at Tradesure we’ve tried and tested 5 apps that use GPS to locate and direct you to your nearest fuel stations. Ranked 1 – 5 to determine what works best on the go.

Can I drive any car on a motor trade policy?

A motor trade policy is designed for people who drive other people’s cars as part of their business. Can you drive any car on it?

What is a road risk policy?

A road risk policy is a type of insurance that covers you to drive other people’s cars on the road, as part of your business.

Motor traders who reduced cover in the pandemic could be underinsured

Reduced indemnity or cover levels through Covid could come back to bite traders if cover is no longer sufficient for their needs.

Changes to the car market in the past 12 months

New car shortages, price changes and the pandemic have all played a part in major car market shifts in the past year. So what’s changed?

Motor legal protection: is it worth it?

Motor legal expenses cover gives you access to legal advice and can cover some legal costs if you get into an accident – but is it worthwhile for a motor trader?

Used electric vehicles – what’s the demand?

Used electric vehicles are selling just as quickly as petrol and diesel cars, for the first time ever. Is this a trend that’s here to stay?

Birmingham to host first UK Garage and Bodyshop Event

The two-day event for garage and bodyshop owners will take place at the NEC from the 8th – 9th June 2022 and is organised by Messe Frankfurt.

New mobile phone driving law fines drivers £200 for using phone

New driving laws mean drivers who use their mobile phone could be fined £200 and get 6 points on their licence, with new drivers having their licence revoked. The law comes into force on 25th March 2022.

Accidents, thefts & car insurance premiums during the pandemic

Road deaths fell during the pandemic, while vehicle thefts increased. Car insurance premiums remained low in 2021 though, with fewer car insurance claims the previous year.

DVLA delays: Cancelled driving tests & anxious learners

Around 450,000 driving tests were cancelled during the pandemic as the DVSA struggled to fulfil demand for learners keen to get their licence.

The rise of second-hand car sales in the pandemic

Second-hand car sales went through the roof during the pandemic, and prices for used cars seem set to stay high. We look at where this trend has come from.

The open road: average mileage during the pandemic

The average car mileage in the UK during the pandemic dropped by 70%, from 667 miles per month to 198 miles per month in October 2020.

Highway Code changes give priority to cyclists and walkers

New changes to the Highway Code finally came into force in the UK on 28th January.

5 new driving laws to know about in 2022

From electric charging points in new buildings to local councils enforcing driving fines, 2022 will see a few different driving laws introduced on UK roads. As we enter the new year, it’s always helpful for motorists to stay on top of any new laws which come into play so as to avoid any mishaps on […]

Smart motorway construction paused after safety concerns

The government has temporarily stopped the rollout of ‘all-lane running’ smart motorway across the UK because of worries over how safe they are for drivers. A critical report was released in November 2021 by the Department for Transport (DfT), which said government plans to remove permanent hard shoulders from smart motorways in the future was […]

When will fuel prices drop in the UK?

Since the chaotic fuel crisis in September, the UK has struggled with higher-than-normal fuel prices. The RAC have said that filling the tank of a standard family car is costing drivers around £3.50 extra compared to November 2021. This is pretty expensive considering that in November, global oil prices dropped below US$70 per barrel. Oil […]

Used car prices might not dip below pre-pandemic levels again

Data firm Cox Automotive have spoken out about a possible new normal for used car prices after the pandemic, one where we might never see used car prices drop to the levels they were before Covid emerged. The insight and strategy director for Cox Automotive Philip Nothard said, ‘We expect current market conditions to continue […]

Chris Wilkinson

It is with great sadness that we announce the passing of our founder, Chris Wilkinson. Chris passed away peacefully on 5th December after a short illness. He had retired as Chairman of Norton Insurance in early 2020, after 55 years’ dedicated work in the business he created.

Christmas crossword

We’ve put together a fiendishly tricky Christmas crossword to test your festive knowledge. It’s a difficult puzzle, so for anybody who gets 20/20 questions correct, we’ll add your name to the honour roll in our next newsletter! Make sure you send us your answers through email or post it to us. You can find more […]

The most popular used cars to buy in 2021

According to data from the AA, the Ford Fiesta has taken the crown for the most popular used car in the UK during the first half of 2021. This won’t come as a shock to many dealers, given the Fiesta’s 6-year winning streak so far (soon to be 7 if it keeps up this year’s […]

Tips to get your small used car dealership online

After three lockdowns and stay-at-home rules, Covid has showed us that there are plenty of good reasons to get your small used car dealership online. Having your own website or online presence isn’t something only reserved for car giants anymore, with plenty of smaller companies creating their own websites to boost sales. Having a website […]

What should used car dealerships expect in 2022?

With 2022 just around the corner, there are a few things to keep going into next year. From the massive spike in prices to the new car shortage, there have been a few ups and down to say the least. It looks as though 2022 will still be feeling the effects of a lot of […]

Driving licences available as a digital app in 2024

In 2024, the DVLA is planning to release a digital driving licence app. The new app can be used instead of a UK photocard or paper driving licence. It won’t be compulsory for everyone to make the switch; drivers can choose whether or not to use the app, and can still use their photocard licences […]

Inflated used car prices leaves small dealerships struggling to buy stock

Between January and August this year, used car prices rose by 16.6%. These rocketing prices were welcomed by lots of motor traders, but finding stock has proved difficult.

20% increase recommended for vehicle delivery costs

DMN Logistics, a Birmingham-based inspection firm, has recommended a 20% price increase to collect or deliver vehicles in the UK as part of an effort to sustain stock volume levels. This might not be bad news for small motor trade businesses; after all, it’s pretty common to collect new stock yourself. However, it’s definitely something […]

Top tips to help boost second-hand car dealership sales

The second-hand car market is still riding on a big boom and after the difficulty of lockdown, it’s well-deserved. As sales continue to flourish, there are a few ways to make sure you maximise your profits and keep sales high. We’ve included a few top tips from industry experts to help you get the most […]

Customers still want to visit dealerships before buying a used car

Plenty of car dealers will be pleased to know that customers still want to visit a dealership before buying a car. The State of the Nation Industry Report 2021 by JudgeService contained the results of a survey with 2,150 participants, all of whom had purchased a car in the last few years. It showed that 73% […]

Semiconductor shortage expected to fuel used car price boom into 2022

The shortage of semiconductors is still raging on around the world. According to Car Dealer Magazine, it might even continue into next year. As many of you already know, the issue started at the beginning of 2021, and has had a huge knock-on effect by creating a shortage of new cars. As a result, the […]

The benefits of buying a used car from a dealer instead of privately

When customers look for a new set of wheels, they’re faced with two choices: buy from a dealer or a private seller. There are benefits to both, but as any dealer will know, customers are in the safest hands when buying from somebody who knows what they’re talking about. There are a couple of things […]

Are used cars being priced too low?

There’s a boom in used car prices in the UK happening at the moment, with some price tags even rising by the thousands. However, it doesn’t look like every dealer has jumped on the trend. INDICATA has released data showing that as many as one-in-four used cars could be priced too cheaply. Car Dealer Magazine […]

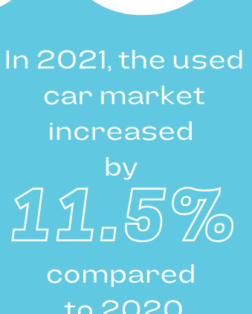

Used car sales continue to climb in the UK

There’s light on the horizon for many used car dealers, as car sales continue to climb. And, after the rock bottom sales of the early lockdowns, the news can’t come soon enough. At the end of March 2021, used car sales had risen 32.3% year-on-year compared to 2020, with around 638,570 cars sold according to […]

Free webinar to explain how Birmingham Clean Air Zone could affect your business from 1st June

The delayed Birmingham Clean Air Zone will launch on 1st June 2021. This will mean a daily charge for those driving their vehicles in the new zone, and is likely to affect local businesses with commercial vehicles in the area. To help businesses prepare, the government in partnership with the Greater Birmingham Chambers of Commerce […]

The surge in online vehicle sales within the motor trade

The UK is on a steady return to normal this year, with non-essential businesses such as trade dealerships allowed to reopen this week with safety guidelines in place. However, the past year of COVID-19 lockdowns and restrictions has had a huge impact on the way many motor trade businesses operate. Dealers both big and small […]

Motor trade dealerships reopen as restrictions lift

As non-essential businesses slowly start to reopen across the UK, we take a look at what this means for motor trade dealerships.

How can combined motor trade insurance help you?

With so many types of motor trade insurance, we explore how combined motor insurance can help you fit all the cover you need into one policy.

How can your no claims discount help you with your motor trade insurance?

We discuss what your no claims discount is, why it can be useful to you and how to prove you have one if you need to switch your insurer.

How will electric cars affect the motor trade industry?

With the 2030 ban on selling new petrol and diesel cars, we discuss the effect that electric cars could have on the motor trade industry.

Your responsibilities as a car dealer

We discuss your legal responsibilities when selling cars, and the Coronavirus guidelines to follow when meeting your customers in person.

Who can get motor traders insurance?

Motor trade insurance is designed for people working in the motor trade, which can include valets, garages and repair shops as well as car sales.

Car dealers to wear masks under new COVID rules

Car dealers will need to wear face coverings from Monday 28th September following new COVID-19 guidelines laid out by government. Businesses can be fined for breaking the rules.

Motorists putting off car servicing due to financial constraints

32% of motorists in a recent survey are putting off car servicing because of financial constraints during COVID-19, and MOT demand is on the rise.

HOW CAN MOTOR TRADERS BENEFIT FROM THE RISE IN DEMAND FOR USED CARS POST-LOCKDOWN?

With many sources anticipating a big rise in demand for used cars post-lockdown, and many used car dealers struggling to meet that demand due to a lack of stock, we’ve taken a look into how you can turn this change in the market into a benefit for your business.

CUSTOMERS MUST WEAR A FACE COVERING WHEN ENTERING A GARAGE OR SHOWROOM

Customers must wear a face mask when visiting a car dealer or garage, according to new government rules.

MOT EXEMPTION TO END ON 1ST AUGUST

It has been announced that mandatory MOT testing will be reintroduced from 1st August 2020, and drivers will no longer be granted a 6-month MOT exemption.

A guide to online car auctions during lockdown

We’ve written before about buying cars at auction, but how about during lockdown measures – how do you work with online car auctions?

Will non-essential travel invalidate my vehicle insurance?

Stories in the media stating that non-essential travel will invalidate people’s vehicle insurance are untrue, according to insurers.

Resources for motor traders during lockdown

Information on resources and support available to small business and self-employed motor traders during the coronavirus lockdown.

What Are Trade Plates For The Motor Trade?

Trade plates are temporary number plates needed for unlicensed cars, saving motor traders time and money as they don’t need to individually register and tax each vehicle. Find out how to apply for trade plates and how much trade plates cost here.

Are price indicators damaging business for motor traders?

Motor traders are continuing to express concern that new price markers on online car sales sites may have a negative impact on their ability to sell their vehicles.

10 reasons your motor trade policy could be cancelled

It can be a challenge getting the right motor trade cover set up – once you do, you want to make sure it runs smoothly. Your insurance provider will consider many factors in validating your cover. If you fail to advise your insurance company of any changes to your policy…

Government plans announced to tackle smart motorway safety concerns

The UK government has published its action plan to address smart motorway safety concerns, following a report that revealed 38 people had died on smart motorways in the past 5 years.

5 motor trade insurance extras that could protect your business

Insurance is all about protecting your business, but as with any insurance, your standard motor trade insurance will only cover certain aspects of your business. There are many additional options that are sensible to consider…

Top Second-hand Cars

With second hand vehicles proving extremely popular, motor traders know that spotting the best value gems on the market can make them a tidy profit when they re-sell.

Car Auctions In The East Midlands

We’ve put this list of car auctions in the East Midlands together so you don’t have to struggle to find the best auction houses in your area.

Car Auctions In Yorkshire

We’ve put this list of car auctions in Yorkshire together so you don’t have to struggle to find the best auction houses in your area.

Car Auctions In The North-East

We’ve put this list of car auctions in the North East together so you don’t have to struggle to find the best auction houses in your area.

Car Auctions In The West Midlands

We’ve put this list of car auctions in the West Midlands together so you don’t have to struggle to find the best auction houses in your area.

Car Auctions In The South-West

We’ve put this list of car auctions in the South West of England together so you don’t have to struggle to find the best auction houses in your area.

Car Auctions In The North-West

We’ve put this list of car auctions in the North West together so you don’t have to struggle to find the best auction houses in your area.

Car Auctions In Wales

We’ve put this list of car auctions in Wales together so you don’t have to struggle to find the best auction houses in your area.

Car Auctions In Scotland

We’ve put this list of car auctions in Scotland together so you don’t have to struggle to find the best auction houses in your area.

What’s the difference between a fault and a non-fault claim?

There is often confusion around the difference between a fault and a non-fault insurance claim, and what claims should be disclosed when taking out a policy.

Whether a claim is defined as fault or non-fault is not to do with whose fault any accident or damage is – it’s about how insurers categorise claims based on cost recovery outcomes.

Smart motorway deaths prompt government review

38 deaths have taken place on smart motorways in the last 5 years, a freedom of information request has revealed.

The BBC’s Panorama reported that near misses on one stretch of the M25 have increased 20-fold…

CHRISTMAS AND NEW YEAR OPENING HOURS

This Christmas our office will be open until and including the 23rd December at our regular hours of 8:30am to 5:30pm, following which we have some variations to our usual hours between Christmas and New Year. Regular hours resume from the 2nd of January 2020.

Is it the law to have business insurance?

Whether you’re setting up your own business or have been running one for a while, the subject of business insurance can raise questions. How do you know what is a legal requirement? Which extra covers are worth your hard-earned money, and which are a waste?

A quarter of drivers think smart motorways are unsafe

Nearly a quarter of drivers in the UK believe smart motorways are unsafe, and many do not understand the rules around hard shoulder running, according to recent research by Kwik Fit.

Brexit and Green Cards: an update

As 31 October approaches, uncertainty continues about whether the UK leaves the European Union without a Withdrawal Agreement (a ‘no-deal Brexit’). If this happens, UK motor insurance customers driving in the European Economic Area…

Driver Fatigue: The Risks Of Driving Tired

On a day that celebrates the importance and benefits of sleep, it’s sobering to recognise that driver fatigue has contributed to one in six road crashes resulting in death or injury on major roads

Top Five Classic Cars Under £5000

The classic car market is always evolving, and while some cars are guaranteed to be their marque’s poster child for decades to come, the popularity of other models changes over time.

Cybercrime – A Growing Threat To Businesses

Cybercrime covers a number of computer-based criminal activities that can put your business at risk.

No Deal Brexit Would Mean New Rules For Motorists

The BBC has reported that UK motorists travelling abroad after the 29th March will be required to carry proof of insurance, known as a Green Card, in the event of a no deal Brexit.

Increase In Van And Tool Theft: The Trader’s Response

Recently, UK tradesmen are grouping together to get their voices heard about their fears in regards to recent spikes in van and tool theft.

Mercedes Benz Sprinter Review

Here at Tradesure, we know that as many of our customers are tradespeople, having a reliable van is crucial.

There are so many vans on the market and it can be confusing to know which one is worth the investment.

Why industry accreditation will lead to more sales for car dealers

When buying anything from a television to a car or house, having trust in the person you are buying from is crucial.

What Do Customers Look For In A Garage?

Here at Tradesure, many of our customers are mechanics with bodyshops and garages.

So, we thought it would be helpful to take a look at the things owners and managers that insure with us, can do to increase both first time and return custom.

Top Tips For Driving In Ice And Snow

Driving throughout winter can be tricky when snow and ice cover the road, especially if you’re out on a job early and coming home late.

If duty calls, there is no alternative to packing your tools and heading off to a job.

Car Accidents On The Rise In Latest Government Report

The latest data on reported road casualties in the UK has been released by the Government, showing UK traffic accidents are on the rise again.

As our Tradesure customers are out on the roads more than most, it’s important to stay safe and keep your wits about you.

You Could Soon Be Fined For Parking Up The Kerb

A warning to all our customers, parking on the pavement could soon mean a ticket and a fine.

If you’re a car dealer, a mobile mechanic or a commercial tradesman outside of London, you probably park up the kerb sometimes.

Top Car Cleaning Products

Keeping your vehicles clean can take time and effort, but it is always worth it when you see the finished shining results.

What People Look For In A Car Mechanic

Here at Tradesure, the cover we provide for car mechanics allows them to do their business safe in the knowledge they have the appropriate insurance in place.

New Mobile Phone & Driving Rules

New rules will see drivers hit with £200 fines and six penalty points for using a mobile whilst driving. The current law is £100 and three penalty points.

Is Your Car Registered On The Mid? New Motor Trade Law Could Affect Your Insurance

The Motor Insurance industry could be set for a big shake up as a review begins into compensation rights for victims of accidents and damage on private land. The review was prompted from a ruling by the European courts in 2014 which resulted in the Vnuk judgement.

What Is The Mid?

The Motor Insurance Database (MID) is a central record of all insurance vehicles in the UK, and is managed by the Motor Insurance Bureau (MIB). The MID is mainly used as a way for the Police and the Driver and Vehicle Licensing Agency (DVLA) to enforce motor insurance laws.

How to minimise the cost of your motor trade insurance policy

Whatever part of the motor trade industry you work in, there are ways you can mitigate the impact of rising insurance policy costs. These include measures to reduce claims of your own, measures to reduce claims against you, and other ways to generally make sure you’re not paying over the odds.

Top Ten Best Used Small Cars To Buy And Sell

Tradesure Insurance run through the top ten best used small cars to buy and sell in the Motor Trade 2015. With the multitude of small hatchbacks about it’s never easy to select the cars that are right to buy for your stock.

FREQUENTLY ASKED QUESTIONS

Do I Need A Motor Trade Insurance Policy?

If you are trading vehicles, buying and selling them on a part time or even full time basis then you will need a motor trade insurance policy. If you are repairing or servicing other people’s vehicles, where you have a customer’s vehicle in your care, custody or control for the purpose you will need a Motor Trade Insurance policy…

Can I get immediate cover over the phone ?

If you are trading vehicles, buying and selling them on a part time or even full time basis then you will need a motor trade insurance policy. If you are repairing or servicing other people’s vehicles, where you have a customer’s vehicle in your care, custody or control for the purpose you will need a Motor Trade Insurance policy…

Will You Update the MID On My Behalf?

If you are trading vehicles, buying and selling them on a part time or even full time basis then you will need a motor trade insurance policy. If you are repairing or servicing other people’s vehicles, where you have a customer’s vehicle in your care, custody or control for the purpose you will need a Motor Trade Insurance policy…

Sed ut perspiciatis unde omnis iste natus orror sit voluptatem accusantium doloremq ?

If you are trading vehicles, buying and selling them on a part time or even full time basis then you will need a motor trade insurance policy. If you are repairing or servicing other people’s vehicles, where you have a customer’s vehicle in your care, custody or control for the purpose you will need a Motor Trade Insurance policy…

Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores eos ?

If you are trading vehicles, buying and selling them on a part time or even full time basis then you will need a motor trade insurance policy. If you are repairing or servicing other people’s vehicles, where you have a customer’s vehicle in your care, custody or control for the purpose you will need a Motor Trade Insurance policy…