Despite many challenges, the pandemic has had some positive impact on the roads. In 2019, there were 1,748 road deaths caused by road traffic accidents. During 2020, however, the number of road deaths fell by 17%. Likewise, the number of casualties of all severities dropped to 115,584: a 25% decrease from the figures in 2019. It could be assumed that this decline is down to fewer people being on the road during lockdowns, as well as an increased number of people working from home.

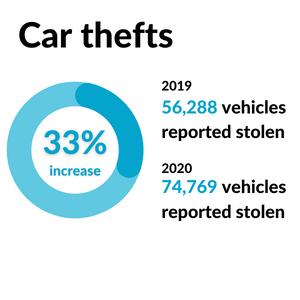

With more cars parked up in driveways, however, it’s interesting to note the number of car thefts which took place during the pandemic. According to This is Money, there were 56,288 cars stolen in the UK throughout 2019. This was considerably lower than the number of cars stolen in 2020, which recorded 74,769 cars taken. So surprisingly, there was actually a rise of 33% during the first year of the pandemic. On average, this means the number of cars stolen throughout 2020 stood at an enormous 205 per day.

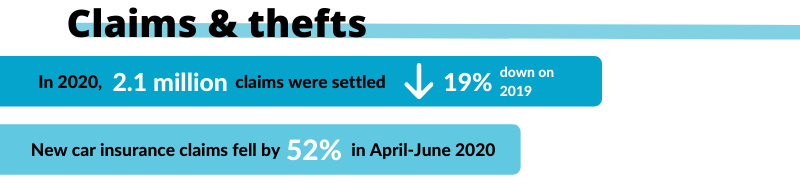

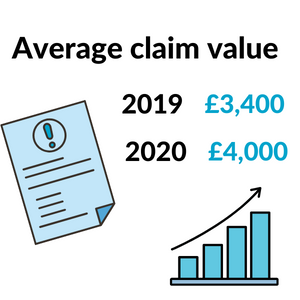

What does all this mean for car insurance premiums? According to ABI, there were 2.1 million claims settled in the UK during 2020, which was a 19% decrease from 2019. However, the average price of a claim rose from £3,400 in 2019 compared to an average of £4,000 in 2020.

Additionally, in Q2 the number of new motor insurance claims was recorded at 324k, a 52% drop from the 678k figure in Q1. Comprehensive car insurance premium prices also dropped by 12% between Q2 of 2020 and July 2021.

It’s hard to predict how the pandemic will affect car insurance premiums through 2022. ‘During the pandemic, we saw car insurance premiums fall quite low, as there were fewer people on the road and therefore fewer claims,’ said Tradesure’s Matthew Liscott. ‘Premiums have remained low throughout 2021, dropping by 16% in the third quarter of the year.

‘It’s difficult to say exactly what will happen to premium costs in 2022, as there will likely still be supply issues affecting the market. However, as more people return to the road, we could see car insurance premiums climb back up to pre-pandemic levels.’

It will be interesting to see how 2022 unfolds as the UK Covid restrictions come to an end. At the start of the pandemic, used car dealerships struggled enormously, with fewer people buying cars and showrooms having to close. Since then, used car prices have hit record highs, and stock levels have become the new challenge. We’re glad to see some prosperity returned to the used car motor trade industry over recent months, and hope that it can continue to work toward greater stability as we move through 2022.

Our advice is to stay on top of industry costs when valuing your stock, and make sure you have the right insurance cover in place to protect your motor trade business. At Tradesure, we specialise in providing car insurance for business use, offering a range of competitive motor trade insurance policies to suit you. These include road risk cover to protect you when driving other vehicles, combined road risk insurance which also covers your business premises and contents, as well as commercial fleet insurance for those with three or more company registered vehicles. We also offer policies such as employers’ liability cover and public liability, so you can cover legal costs.

Get in touch with one of the team today on 0121 248 9300 to see how our insurance options could suit your business.

Check out our infographic below looking at vehicle claims and theft trends during the pandemic.

To read more about how the Covid-19 pandemic has affected our driving habits and the motor trade, visit our ‘Driving Force’ research piece here.