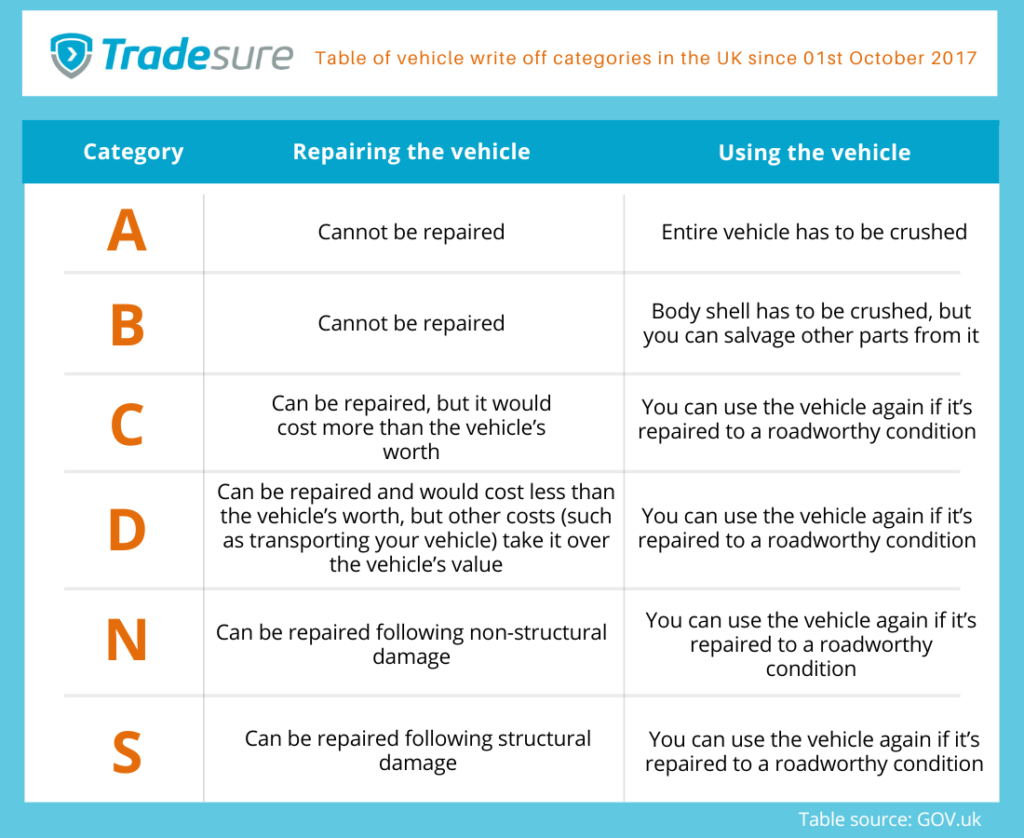

A,B,C,D… no, it’s not the alphabet song. These are some of the codes for categorising written off vehicles depending on their damage.

Back in 2017 the categories for vehicle write-off changed, and it’s important to know what they mean if you ever find yourself in the unfortunate position of having a car written off.

What does it mean if a car is written off?

A vehicle can be written off for a number of reasons. Usually it’s because the repairs will cost more than the vehicle value, to be more economical, or because the car is irreparable.

1- The cost to repair the car is higher than the actual value of the vehicle. For financial reasons, the insurer will pay out the current value rather than the cost to repair which is higher.

2- It’s more economical to scrap than repair. An economic write-off refers to the repair-to-value ratio where it may cost, for example, 50% of the vehicle value in repairs (this percentage varies with insurers).

3- The vehicle is damaged beyond repair. A vehicle written off as a total loss will be given the category A or B, and has no chance of recovery (with the exception of some parts potentially being salvageable in a category B write-off).

The write-off (WO) categories come in to determine the final fate of the vehicle. For example, if the vehicle has been written off for ‘economical reasons’, this would be a category D. The option to buy the car back and have it repaired is still there, and the vehicle could be made road safe again.

In other circumstances, where a vehicle is written off and categorised a category A, it means the motor is deemed unsafe for the roads and will be scrapped.

What are the main changes to vehicle write-off categories?

For a long time, write-offs were been grouped into just four categories: A, B, C and D. Ordered by severity, category A is for irreparable damage and category D is for vehicles that may be repaired & made road safe again.

The new coding introduced in October 2017 includes two new categories, S and N:

S – Structurally damaged but repairable

N – Not structurally damaged, repairable

Insurance write-offs

When you make an insurance claim because your vehicle is damaged, your insurance company’s claims team will tell you if your vehicle is being ‘written off’ instead of repaired.

When your car is deemed as written off, the insurers are essentially making the decision to pay you the value (trade value if a motor trade policy) of the vehicle, instead of the cost of repairing it which in most cases is a higher amount.

Your insurance company will usually deal with getting the vehicle scrapped for you. However, you’ll need to do some legwork too.

• First, if you want to keep the registration on the doomed vehicle, you must apply to take the registration number off the vehicle.

• Then, send the vehicle log book (V5C) to your insurance company – but keep the yellow ‘sell, transfer or part-exchange your vehicle to the motor trade’ section from it.

• Finally, it’ll be your job to tell DVLA that your vehicle has been written off.

A vehicle write-off is never a fun experience, and sometimes you’re really not keen to let it go. Fear not: there may be a way of salvaging your vehicle from the jaws of the car crusher, depends on the category the write-off is classified as .

Keeping the salvage

If you want to keep the salvage of a vehicle in category C, D, N or S, the insurance company will give you an insurance pay out and sell the vehicle back to you. The amount they sell it back for depends on the vehicle & its condition/damage.

Note; If it’s insured under a motor trade policy, the pay out is usually the trade value.

If you do decide to salvage your vehicle, you’ll usually need to send the log book to your insurance company, and apply for a free duplicate log book using form V62.

DVLA will record the vehicle’s write-off category in the log book. You can keep the log book if you want to keep a category D or N vehicle.

Failing to keep the DVLA appropriately informed as outlined above could result in a £1,000 fine. And that’s the last thing you want when dealing with a claim.