The Motor Insurance Database (MID) is a central record of all insurance vehicles in the UK, and is managed by the Motor Insurance Bureau (MIB). The MID is mainly used as a way for the Police and the Driver and Vehicle Licensing Agency (DVLA) to enforce motor insurance laws.

The MID was established by the UK Motor insurance industry in 2001 in order to hold details of all insured vehicles in the UK. This was created to enable enforcement agencies such as the police, to use the information to tackle the issue of uninsured drivers in the UK. It allows easy identification of vehicles being driven without proper insurance cover on the UK roads.

The MID also assists the UK with compliance for the 4th and 5th EU Motor Insurance Directives. These directives require that insurance details of all vehicles can be easily identified by their registrations plate.

Best practice guidelines have been set out so that that the MID is managed effectively which means ensuring that records are complete, accurate and updated as quickly as possible. As a motor trader it’s likely that you have motor trade insurance which means you have one policy that covers multiple vehicles.

The MID is updated by the motor insurance industry. This means companies such as Tradesure Motor Trade Insurance. The MID is managed by the Motor Insurers’ Bureau (MIB). When you add new vehicles to your policy or remove any simply speak to a member of our Tradesure team by calling 0121 248 9300 and we’ll be happy to update your records for you.

Why is updating the MID important?

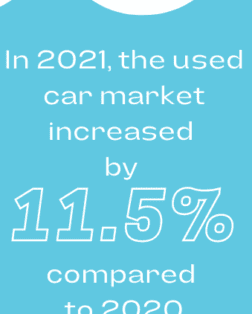

Insurance can be expensive, and the cost of the premiums is based on various risk factors and statistics; a small amount is also added to your premium to cover the cost of illegal road users. Uninsured drivers cost the UK motorist over £500 million ever year, and this cost is paid for by increasing your insurance premium.

To avoid this problem insurers work with the Motor Insurance Bureau (MIB) who are responsible for the development and operation of the MID. The Police use the MID to check if vehicles have insurance and make about two million enquiries per month, with nearly 180,000 uninsured vehicle being seized in 2009 alone.

Do I have to add all my vehicles on to the MID?

Yes, you must add all vehicle that are currently in your possession whilst on a motor trade insurance policy to the MID. You must also add trade plates that you own. Although it is not necessary to add untaxed stock vehicles we advice you do so as there is no impact of this.

By making sure that the MID is kept up to date of any motor trade vehicle you need on cover, and any that you need to be removed, this then mean that the police can then concentrate on vehicles which are actually uninsured.

You’ll also save your drivers and yourself the time and possible embarrassment of being stopped by the police, as well as the expense of having to recover any vehicles that have been seized.

How do I update my records on the MID?

Depending on who you are insured with you either need to inform your insurance broker/insurer or you can update the MID directly.

If you’re insured through Tradesure Insurance, you’ll find that most of our insurers have an online portal to add and remove vehicles. We will provide you with a link to this which you can access 24 hours a day. You can also view the vehicles you have in stock. However because we offer a private client managed service here at Tradesure Motor Trade Insurance, we are also happy to do this on your behalf so do not hesitate to call us on 0121 248 9300.

If you’re unsure of how you should be updating your records or want to get in touch with our team simply get in touch by calling 0121 248 9300.

How long do I have to add a vehicle to the MID?

Recent advice suggests that you add any vehicles you wish to include on your motor trade policy immediately. If you don’t add your vehicles to the MID you do run the risk of being stopped by police whilst you are driving the vehicle and even having the vehicle seized.

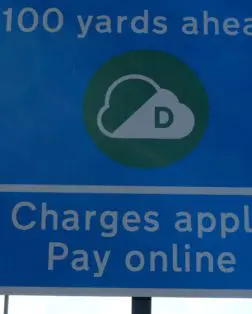

The Automatic Number Plate Recognition (ANPR) network used by the police are continually updated with information about potentially uninsured vehicles, which includes motor trade vehicles which have not yet been added to the MID. When a potentially uninsured vehicle passes an ANPR camera the police are alerted and the driver may then be stopped, if the vehicles aren’t up to date, it could be seized.

Information on potentially uninsured vehicles, which includes motor trade vehicles that have not been added to the MID but should have been, is provided regularly to the police to feed into their Automatic Number Plate Recognition (ANPR) network. When a potentially uninsured vehicle passes an ANPR camera the police are alerted and the driver may be stopped. If the vehicle and policy details are not up to date, it could be seized.

How long do I have to remove a vehicle from the MID?

It is important you remove the vehicle off the MID database as soon as you can. If the vehicle was in an accident before you had removed it from the MID, you could be liable if you have left the vehicle listed on your motor trade insurance policy.

Will you add vehicles to the MID for me?

Yes we can certainly do this for you free of charge. As Tradesure offer a personal client managed service, where you deal with the same person every time, just give us a call and we will happily update the MID on your behalf. Unlike other insurance companies we do this for you for free too every time. Simply contact our team on 0121 248 9300.

How can I check if my records on the MID are up to date?

You can either speak to your insurer who will check this for you, or you can check that your records of your vehicles are up to date by using their free service which allows you simply enter your vehicle plate registration number and the system will check whether your vehicle records are held within seconds. Check your details now by clicking here to visit Ask MID.

What could happen if I don’t keep my records up to date?

As well as the MID being used as a way to prevent uninsured driving, it also used to support the 4th EU Motor Insurance Directive. The aim of this is the make it easier to manage claims involving drivers from different countries, so it requires that insurers are easy to identify from the registration number. All vehicles, including fleet and motor trade vehicles are covered by this directive. This means that you, the policy holder must keep the MID up to date with your vehicle information whether that is through your insurer, or directly to the MID. All vehicle records must be kept for seven years, failure to do so is a criminal offence and the maximum fine for not submitting data is £5,000.

Which vehicles should be added to the MID?

You should add all vehicles insured on your motor trade policy and all trade plates owned by you to the MID. This includes:

All vehicles permanently registered, owned or leased by your

Temporary vehicles, e.g. courtesy or short term hire vehicles.

Any customer vehicles whilst in the custody or control of your motor trade business.

Any other vehicles which are regularly covered under your motor trade policy.

What information do you need to provide when updating the MID?

The information that You are legally obliged to provide the following information for each vehicle:

Policy number

Vehicle Registration Mark

The date which the vehicle was first insured on the policy

The date which the vehicle ceased to be covered on the policy

You are also encouraged to provide the MID/MIB with information such as the vehicle type, make and model, as this helps police with more accurate vehicle identification at the roadside.

What happens at renewal time?

If you stay with the same insurer you should check whether you have to update your vehicles yourself to make sure they appear on the MID for the new policy period or whether this will happen automatically. If you change insurer at renewal time then you must provide all information about the vehicles which are to be covered by your motor trade insurance policy.

Where can I find more information about the MID?

To find out more information on the MID (Motor Insurance Database) visit www.mib.org.uk

If you would like to speak to the team here at Tradesure Insurance either to check your vehicle records or to get a quote simple call 0121 248 9300